fulton county ga sales tax rate 2019

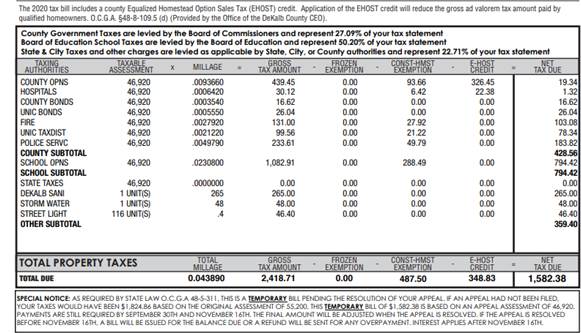

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax.

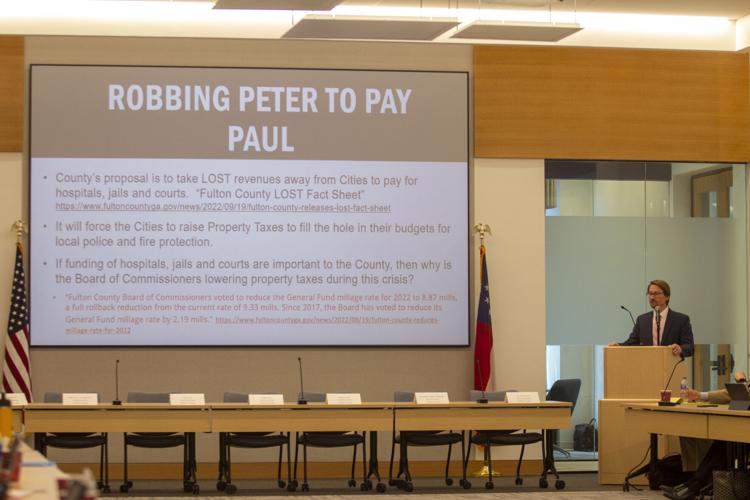

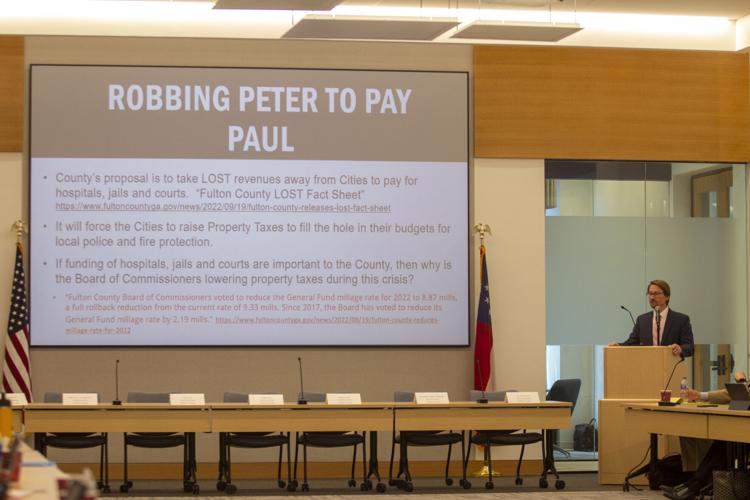

Fulton County Takes Lost Negotiations Out Of Public Eye News Appenmedia Com

Surplus Real Estate for Sale.

. Fulton County Sheriffs Tax Sales are held on the first. The Board of Commissioners and County Manager have categorized County efforts into six strategic areas. The December 2020 total local sales tax rate was also 7750.

Fulton county ga sales tax rate 2019 Wednesday June 8 2022 Edit. Effective January 1 2022 in Fulton County passing vehicle emission inspections are required for 1998 through 2019 model year gasoline-powered cars and light-duty trucks up to 8500 lbs. The 89 sales tax rate in Atlanta consists of 4 Georgia state sales tax 3 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl.

The Georgia state sales tax rate is currently. The minimum combined 2022 sales tax rate for Dalton Georgia is. Fultons rate inside Atlanta is 3.

Sales tax in fulton county ga 2019 Thursday October 6 2022 Edit. Fulton County Tax Commissioner Dr. Effective January 1 2019 Code 000 The.

The Fulton County Tax Commissioner is responsible for the collection of Property. OFfice of the Tax Commissioner. 50 Mobile Ave NE Atlanta GA is a multi family home that was built in 1940.

The current total local sales tax rate in Fulton County GA is 7750. The Fulton County sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v.

The December 2020 total local sales tax rate was also 7000. FULTON COUNTY GEORGIA July 2019 FINANCIAL RESULTS Unaudited Cash Basis. 141 Pryor Street SW.

A county-wide sales tax rate of 3 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. Some cities and local governments in Fulton County collect additional local. In the same year the murder rate.

Ferdinand is elected by the voters of Fulton County. The minimum combined 2022 sales. Fulton County Tax Commissioner Dr.

A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER.

State Lodging Tax Requirements

Fulton County Unveils First New Branding In 30 Years On Common Ground News 24 7 Local News

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Atlanta Georgia S Sales Tax Rate Is 8 9

Fulton Cities Fear County S Proposed Sales Tax Share Increase Will Impact Emergency Services Cw Atlanta

Barrow County Georgia Tax Rates

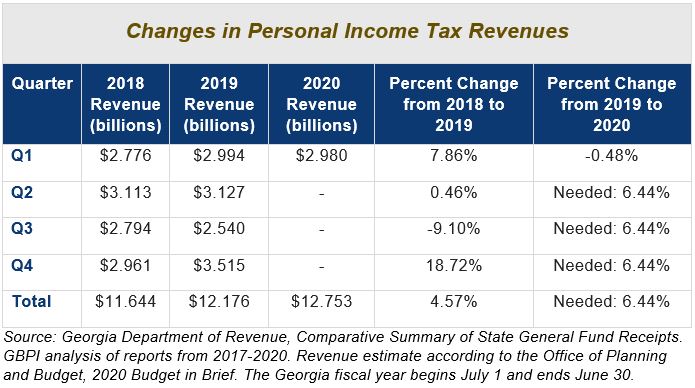

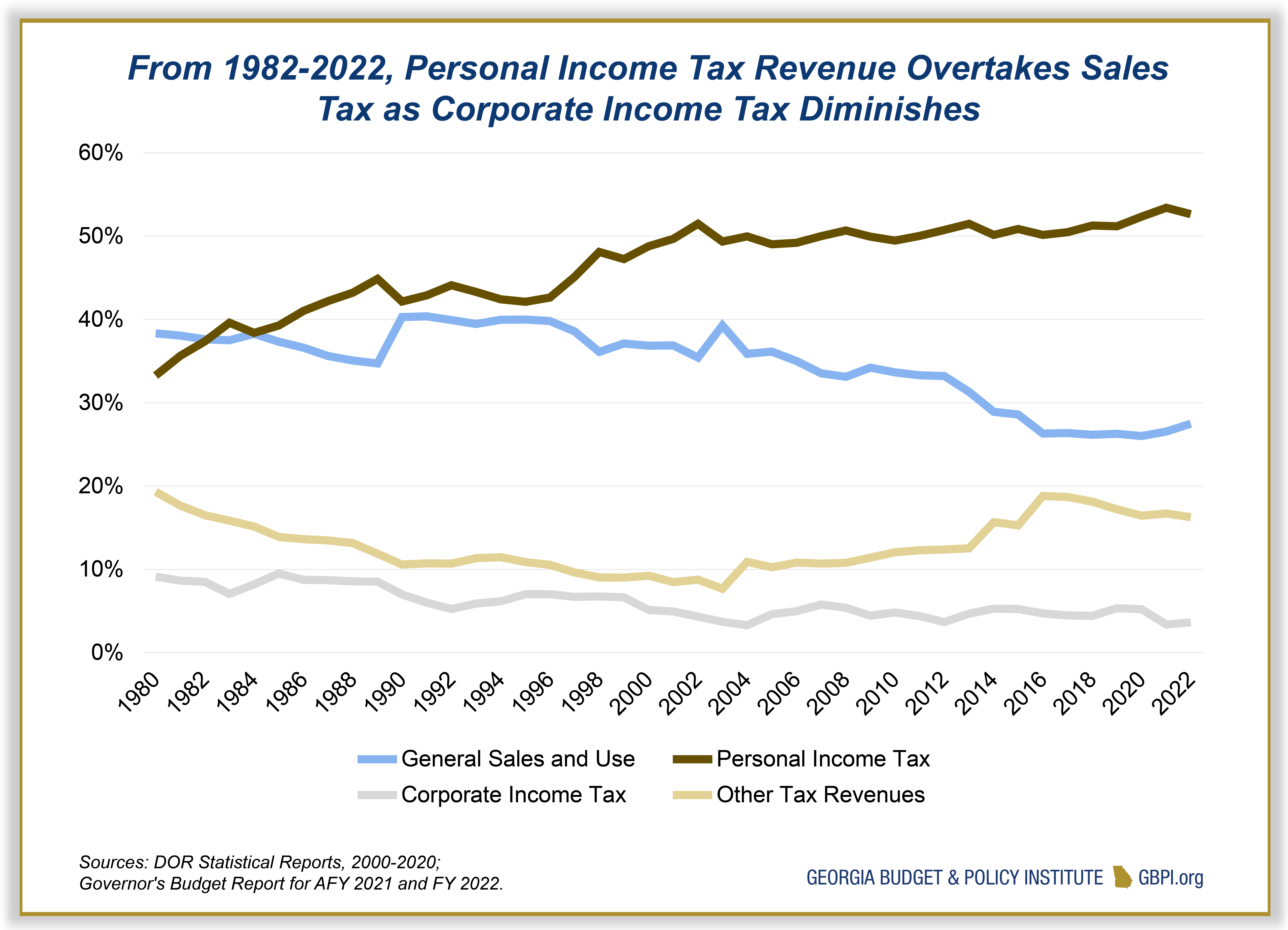

2020 Revenue Collections Fall Short Of State S Estimates Georgia Budget And Policy Institute

County Commissioners Mayors Sign Tsplost Extension

Georgia Used Car Sales Tax Fees

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

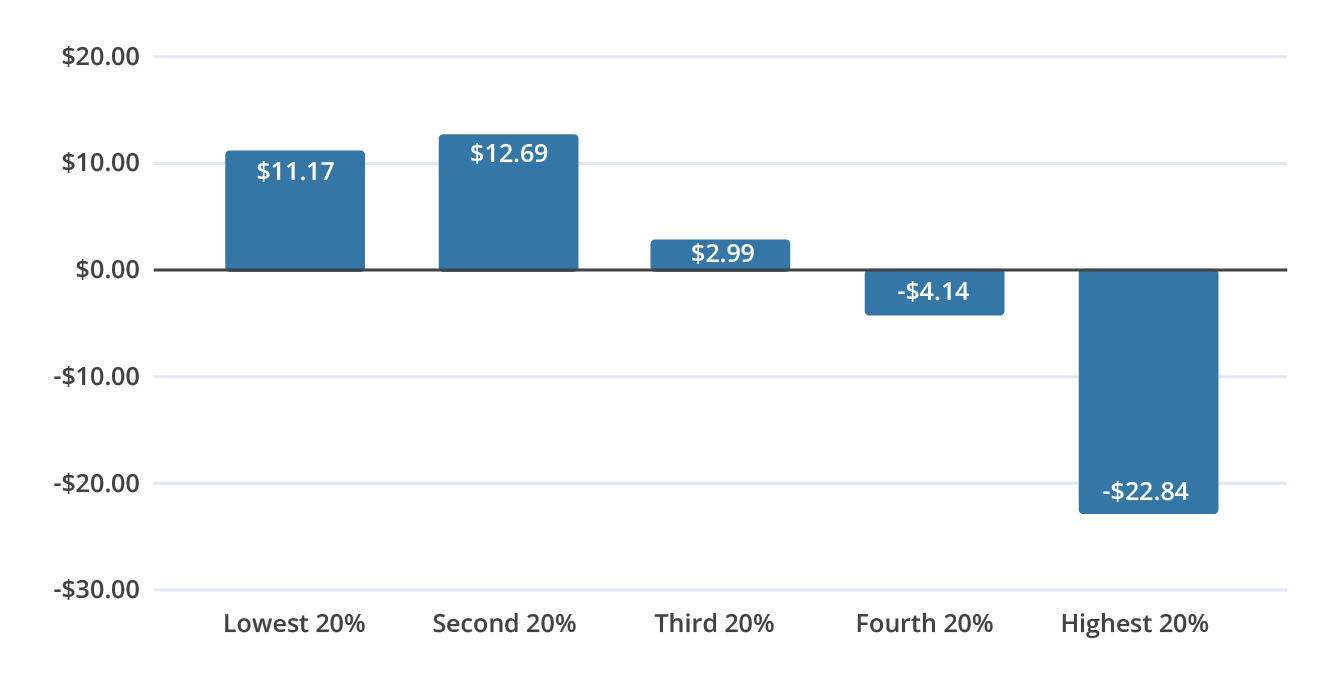

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Property Taxes By County Interactive Map Tax Foundation

Ga Dor 600 2019 2022 Fill Out Tax Template Online

Georgia Sales Tax Rates By City County 2022

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Carbon Taxes Without Tears The Cgo

Tangible Personal Property State Tangible Personal Property Taxes

Ga Application For Basic Homestead Exemption Fulton County 2019 2022 Fill And Sign Printable Template Online Us Legal Forms